Locate the very best Real Estate Experts to Browse Your Home Investments

Locate the very best Real Estate Experts to Browse Your Home Investments

Blog Article

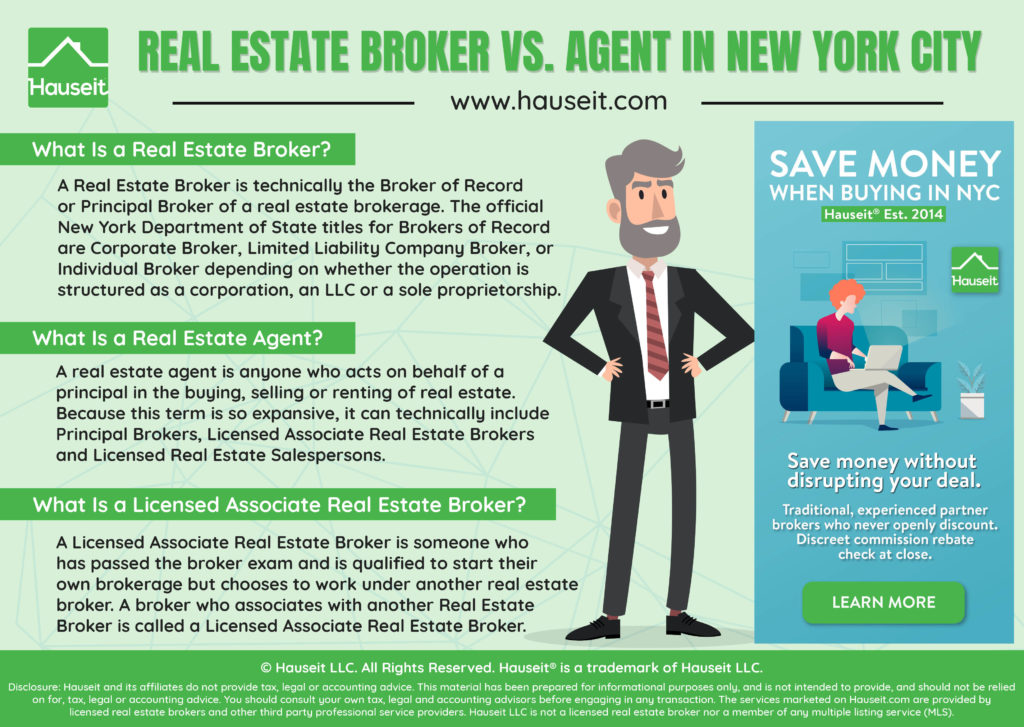

Just How Property Specialists Navigate Market Fads for Effective Investments

Navigating the intricacies of genuine estate investment calls for an eager understanding of market fads, as professionals thoroughly evaluate various signs such as housing costs and supply degrees. The subtleties of local market dynamics and group changes reveal a detailed landscape that bids additional expedition right into the techniques used by these specialists to make sure successful investments.

Recognizing Market Indicators

As the realty market progresses, recognizing market signs becomes important for investors and house owners alike. Market indicators work as essential signposts that assist stakeholders gauge the health and wellness and direction of the realty landscape. Trick indicators consist of housing costs, inventory degrees, and days on the market. By analyzing these metrics, financiers can determine patterns and make educated choices.

Inventory degrees mirror the number of offered residential properties; a reduced stock recommends a vendor's market, whereas high supply can lead to purchaser benefits. Furthermore, the typical days on the market reveal how quickly buildings are marketing.

Moreover, recognizing local market problems is critical, as property fads can differ significantly from one location to another. By very closely keeping track of these signs, investors and home owners can strategically browse their actual estate endeavors, choosing that align with present market realities and future possibility.

Studying Economic Trends

Economic patterns play a considerable function in shaping the genuine estate market, influencing whatever from housing prices to buyer sentiment. Investors have to closely monitor key indicators such as GDP development, joblessness prices, and rising cost of living to assess the general health and wellness of the economy.

Rates of interest, influenced by central financial institution plans and rising cost of living expectations, also have a profound impact on genuine estate investments. Lower rates of interest frequently make borrowing much more economical, spurring demand for home acquisitions and refinancing, while greater rates can dampen enthusiasm. In addition, group changes, such as urbanization and altering house structures, can even more influence market characteristics.

Realty experts use financial signs to forecast market fads, enabling them to make educated investment decisions. By examining these patterns, financiers can determine chances and mitigate threats, making certain that their realty profiles stay durable despite economic fluctuations. Comprehending these factors is essential for navigating the complexities of the realty landscape.

Neighborhood Market Insights

Secret elements of regional market understandings consist of evaluating population development, employment rates, and earnings degrees within details areas. Regions experiencing work development often bring in new locals, leading to boosted demand for real estate. Additionally, comprehending the local rental market can offer useful details pertaining to renter actions and rental pricing patterns.

Financiers should additionally consider the influence of zoning laws, facilities growths, and planned area tasks, as these aspects can substantially impact building values. Connecting with local realty specialists and attending community meetings can better improve a financier's understanding of present market characteristics.

Risk Evaluation Approaches

Efficient risk analysis techniques are vital for real estate capitalists intending to safeguard their properties and make the most of returns. A thorough examination of prospective dangers enables capitalists to make informed choices and mitigate unfavorable end results. Key methods include complete market evaluation, which entails taking a look at financial indicators, market trends, and local residential property worths. Understanding these factors helps identify areas of development and possible decline.

Another necessary approach is to conduct due diligence on buildings prior to acquisition. This includes inspecting physical problems, understanding zoning regulations, and assessing historical performance metrics. Capitalists must likewise evaluate external threats, such as adjustments in click reference federal government plans and ecological elements that could impact home values.

Diversity is an essential strategy to risk administration. By spreading financial investments across various residential property kinds and geographic places, investors can lower the influence of a decline in any type of single market section. Additionally, preserving a robust economic barrier permits for versatility throughout unanticipated challenges.

Inevitably, a proactive technique to risk assessment equips investor to browse market fluctuations successfully, making sure lasting development and long-lasting success. By applying these approaches, investors can position themselves to utilize on opportunities while lessening possible losses.

Devices for Information Analysis

Using innovative devices for data evaluation is important for genuine estate financiers looking for to make educated decisions in a progressively open market. These tools make it possible for investors to collect, examine, and analyze vast quantities of data, giving understandings right into market visit our website fads, property values, and investment possibilities.

One prominent tool is Geographic Information Systems (GIS), which permits financiers to imagine spatial data and evaluate demographic patterns, zoning laws, and property areas. real estate experts. This can be crucial in determining emerging markets and investment hotspots. Additionally, systems like Zillow and Redfin use thorough property information, consisting of historic costs and area statistics, which can aid in comparative market evaluation

Final Thought

Report this page